District Budget & Finances

Message from the Board of Trustees

2023-2024 Budget Development Process and Priorities

Dear CUHSD Community,

At the same time as the 2022-2023 school year comes to a close, the Board of Trustees is developing the budget for the 2023-2024 school year. As this is the first budget that the current Board will put forward for County approval, the Trustees have worked to define budget priorities. On May 25, 2023, the Board conducted a budget workshop to prioritize areas of investment and solidify budget assumptions. Based on this direction, District staff developed a budget proposal which is available for public viewing on the District website and in the District Office.

As the budget contains many pages of detailed budget items, this letter is intended to highlight a few of the areas where the Board prioritized investment as well as describe the next steps in the budget approval process.

2023-2024 Budget Priorities

The Board of Trustees focused investment in the expansion of programs identified by our community to support student needs. These priorities, along with increased compensation for teachers and staff, will require ongoing investment from the general fund.

-

-

- School Counselors: Improve student-to-counselor ratio from 465:1 to 325:1, with an estimated cost of $3.6M over the next three years

- Student Wellness: Provide mental health and student wellness support through CASSY and Pacific Clinic therapists, social workers, and wellness centers, with an estimated cost of $4.3M over the next three years

- Teacher Support: Increase support to teachers by expanding Teacher on Special Assignment (TOSA) positions, with an estimated cost of $2.7M over 5 years

- Equity: Implement the actions identified in the Blueprint for Equity, with an estimated cost of $817,000 over the next three years.

-

Fund Balance

The Board authorized the expansion of the above programs while ensuring that the District maintains savings in the event of an economic downturn. At the end of the 2022-2023 budget, the District is projected to carry over the following funds, referred to as the ending fund balance, to the next budget.

-

-

- $9.1M: Reserve for economic uncertainty

- $28.2M: Unassigned, unrestricted funds

- $26.5M: Restricted funds approved for specific purposes

-

The unassigned, unrestricted funds will be significantly reduced over the next three to five years through a combination of:

-

-

- Expanded programs that require annual funding, highlighted above

- Compensation increases for teachers and staff

- One time expenditures

-

As unassigned funds are spent down, the Board of Trustees will take care to review the annual revenues and expenditures, monitor the financial impact of permanent programs on the budget, and make adjustments when needed. The Board remains committed to ensuring the fiscal stability of the District.

Budget Approval Process

By statute, the District is required to submit a budget to the County Superintendent of Schools by June 30. The Board will review and discuss the proposed budget at the regular meeting scheduled for June 15, and the Board will take action on the budget at the regular meeting on June 22, 2023.

Thank you to all of the CUHSD constituents who have provided input during the budget development process. We look forward to sharing updates as this process culminates; until then, we wish you a restful summer.

Sincerely,

Aine O’Donovan, James Kim, Linda Goytia, Elisabeth Halliday, and Jason Baker

Board of Trustees

Campbell Union High School District

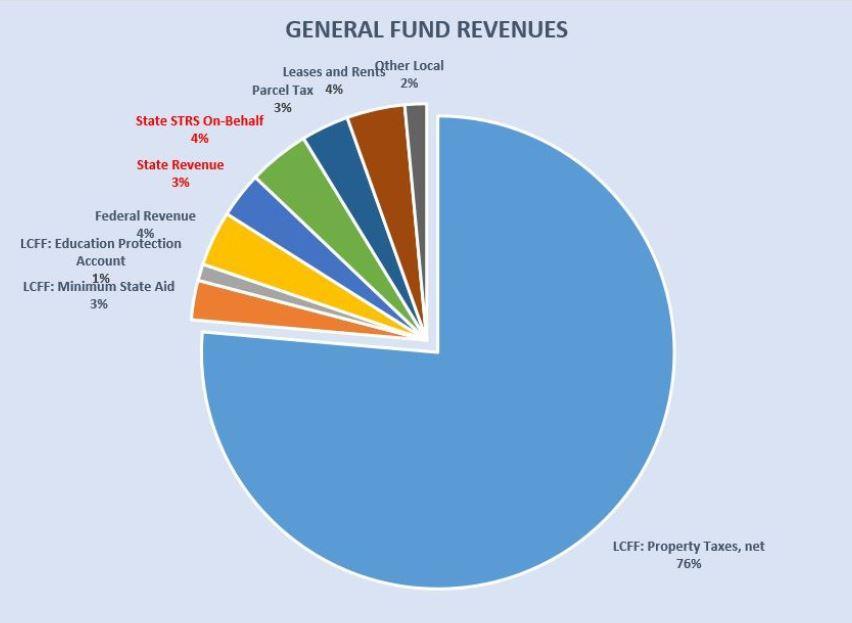

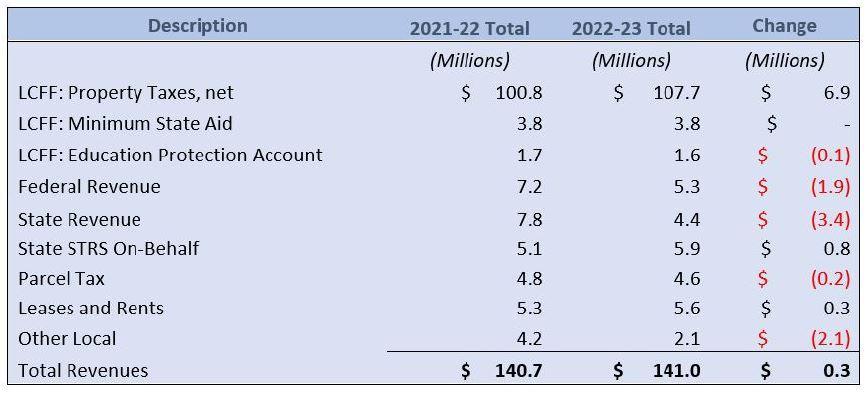

Public school funding comes from multiple sources—local, state, and federal. Through the Local Control Funding Formula (LCFF) C.U.H.S.D. is classified as a community-supported district, which means we receive a majority of our funding from local property taxes and not from average daily attendance as most districts in the state are funded. As enrollment increases, we do not receive additional funding to compensate for the additional staff new students require. Our reputation for prudent fiscal management also gives us the added support of grants and donations to bolster student programs.

We consistently earn excellent reports from independent auditors and outstanding bond credit ratings, which makes us more eligible for grants that stretch the public’s dollar further. Also, a Citizens Oversight Committee monitors district spending of bond and parcel tax funds for compliance with wording in voter-approved ballot measures.